Medium: How BIG is the GIG (Economy)?

By Steven Hill, Medium, September 9, 2015

No one knows the true size of the on-demand economy. That’s a major problem for US workers.

With all the headlines about Uber, Airbnb, Instacart and more, you’d think the gig economy is taking over. And you may be right…or you may be wrong. It turns out the experts disagree on how big the gig economy is, or how many jobs and how many people’s lives are being affected by this shift to new forms of work.

Our understanding of what is happening to the labor force is bedeviled by a fierce numbers game — a numbers game that matters. Because as politicians and policymakers begin designing policy, unfortunately they don’t have accurate data for assessing impacts. Which means we don’t really know how much the gig economy could impact the future, or what policy to erect around it.

In a modern economy, you have to be able to count things. If we can’t count it, we don’t know how big it is or the magnitude of the shift. The current state of the art is like flying a B-2 bomber toward your target, but you don’t have radar or GPS to help you find your destination, or even to figure out your own location.

The Wall Street Journal launched the latest salvo in this discussion, creating a mini uproar in late July with an article entitled “Proof of a ‘Gig Economy’ Revolution Is Hard to Find.” Citing official government data, the article claimed “Far from turning into a nation of gig workers, Americans are becoming slightly less likely to be self-employed, and less prone to hold multiple jobs.”

Many workers cobbling together a living from tech platforms are classified as self-employed. Yet the WSJ report found that the share of Americans who are self-employed has declined over the past two decades, to about 6.5% of workers today, down from as high as 7.7% in 2005 and as high as 8.5% in the mid-1990s, according to Labor Department figures. The share of people who hold multiple jobs is also in decline — only 4.8% of workers, down from 5.5% in 2005 and 6.3% in 1995. Moreover, this data shows that around 95% of those who report having jobs are accounted for on the formal payroll of U.S. employers, which is little changed from a decade ago.

But almost immediately after the WSJ article was published, other researchers rebutted the conclusions and questioned the methodology used (which had included the usual surveys of the civilian population, tracking the number of people paying into the unemployment insurance system and surveying companies on the size of their payrolls). In an article entitled, “There are probably way more people in the ‘gig economy’ than we realize,” Rob Wile at Fusion reported on different data and methodologies that told an alternative story. He quoted Harvard economist Larry Katz, who cited two pieces of evidence that lead him to conclude that current measures of self-employment and multiple-job holding are “missing a large part of the gig economy.”

The Rise of the Gig Worker — Maybe?

For starters, the share of workers filing a 1099 form, which is the IRS document that independent contractors (including gig workers) file, increased in the 2000s, even as standard measures of self-employment declined. Estimates of the proportion of people in several major cities who received 1099 forms ranged from 10 percent to 20 percent. And the proportion of people filing Schedule C (self-employment income) forms with their income tax returns had increased “substantially” in the 2000s, “even though the survey measure of self-employment are down.”

Wile quotes Katz saying, “These discrepancies suggest a growth of ‘gig’ and ‘share’ economy workers who receive 1099 income, file Schedule C forms on their taxes, but don’t answer the standard [government] question as indicating they are self-employed and don’t say they are a multiple job holder.” In fact, Katz’s interviews with gig economy workers found that a majority of those who also have regular, non-gig employment don’t answer that they have “multiple jobs” when asked the standard multiple-jobs question, “even in many cases where they have significant on-line and other non-traditional job income.”

So different methodologies are teasing out different responses from the data, as well as from people’s experiences. A confusing picture has emerged.

US Cities Try to Count an Expanding Gig Workforce

Other sources of evidence support Katz’s finding. Zen Payroll, a service that provides payroll capabilities for businesses, used its employment and payroll data to look at whether the 1099 economy is growing. It found increases in the share of 1099 workers across many major U.S. urban areas. Cities like Los Angeles, Austin, and Orlando show huge increases in the number of 1099 workers, more than doubling to 20 percent or higher of the workforce. The percentage nearly doubled in Seattle and Dallas, with those cities as well as San Francisco, New York City, Chicago and Tampa all showing at least 13 percent of the workforce being 1099 contractors (see bar graph)

And data from research group EconomicModeling.com show the share of traditional, 9-to-5 workers in the labor force has declined to the lowest point in a decade, while those who categorize themselves as “miscellaneous proprietors” has climbed to over 18 percent.

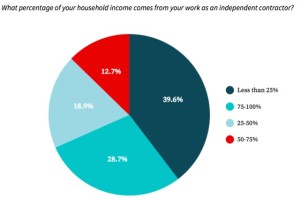

Kevin Roose at Fusion reported on another 2015 survey which polled roughly 1,000 on-demand workers about their work, earnings, and lifestyle. The results found that 60 percent received 25 percent or more of their income from freelance work, and over 40 percent earned half of their income freelancing. These trends appear to indicate a rise in self-employment or at least an increase in the percentage of people receiving self-employment income (see pie chart).

Also weighing in, management software company Intuit released new research which found that 3.2 million American workers are actively engaged in some kind of gig work, at least part-time. Buzzfeed reports that, according to Intuit, by 2020 there will be 7.6 million such people (more than four times the number of Walmart employees, notes Buzzfeed’s Caroline O’Donovan).

Intuit also predicts that by 2020, 40% of U.S. worker will be part of the “contingent workforce.” But this is where vague definitions cause confusion, because in the Intuit study only a small fraction is made up of people who work for gig economy services like TaskRabbit, Postmates, Uber or Instacart. The other contingent workers do more traditional type of freelancing and contracting. But the percentage of on-demand workers is growing, according to Intuit executive Alex Chriss, who says that by 2020, contingent workers will make up nearly half of American workers, and 11 percent of these will be working for on-demand platforms. Yet the Intuit survey found that 80 percent of the respondents are only working part time on these platforms, which means that most of these workers will still have to hold a regular, W-2 type job, in addition to their gig work.

Like Intuit, the Freelancers Union teamed with Elance to produce a study that relied upon an expanded definition of “freelancer” that includes a significant number of regular, W-2 part-time workers. Their 2014 report found that more than one in three workers — 53 million Americans — are now “freelancing,” according to that definition. “Freelancing is the new normal,” says Sara Horowitz, executive director of the Freelancers Union. Critics of the Freelancers Union methodology found it misleading that Horowitz included regular, part-time workers in her estimate. But in Horowitz’s defense, regular part-timers share a lot of work conditions as freelancers, contractors and gig workers, especially with the advent of “just in time scheduling,” such as job insecurity, low pay and little to no safety net. And Horowitz’s estimates are similar to those of other studies and surveys, including one from MBO Partners, which found that within 10 years nearly half of the 145 million employed Americans — about 65 million workers — will find themselves on similar grounds, turned into so-called “independent workers.”

Other Puzzling Trends in the Labor Market: Can We Count This?

While there is raging dispute over this numbers game, many experts nevertheless acknowledge that funny things are happening in the labor force. For example, in a down economy, one puzzling fact for economists has been that though the percentage of unemployed Americans has gone down, the official rate of employed Americans also has been going down, to the point where the employment rate is at its lowest level since 1983. How can that be? In normal times, those two measurements are inversely related — as the number of employed Americans goes up, reflected in a higher employment rate, the number of unemployed Americans, as well as the unemployment rate, goes down. The two are supposed to countervail each other, like opposite ends of a see-saw. And yet in this strange new world, both the employment rate and the unemployment rate have been declining. How is that possible?

The short answer is that it’s because the multitudes of workers dropping out of the labor force and drifting into the grey economy are not counted in official statistics. And the number of such “discouraged workers” (as they are called) has grown large enough that the unemployment rate appears to be declining. Certainly, more and more experts are realizing that the unemployment figures don’t reflect reality. Even Federal Reserve chief Janet Yellen, whose job is to sound as upbeat as possible about the economy, had to admit in February 2015 before the Senate Banking Committee that the overall jobs picture is “less rosy” than the declining unemployment rate indicates. That’s because of the surge of “marginally attached and discouraged workers,” as well as “an unusually large number of individuals who are working part-time who would like full-time jobs,” she testified.

Indeed, the U.S. Bureau of Labor Statistics estimates that 12 million fewer Americans are participating in the workforce, compared to before the onset of the Great Recession. That’s over eight percent of the labor force — it’s as if a giant hole in the earth opened up and swallowed these workers, making them disappear from the traditional labor market. Are they working on the grey market, or black market? Or under the table in the gig economy? Apparently nobody knows.

With all the data and technology at our disposal, it seems ridiculous that it has proven so difficult to track and count these labor market trends. I’m not one to jump on the Ronald Reagan “Government is the problem” bandwagon, but this is one example in which the Labor Department and Bureau of Labor Statistics really have shirked their responsibility to try and assess the size and growth of this dynamic shift to our economy. The U.S. Government Accountability Office (GAO) last attempted a study in 2000 through 2005 of contingent work arrangements, finding that the percentage of the U.S. workforce that could be characterized as contingent or on-demand ranged from 5% to 30%, depending on the precise definitions used. Which is quite a wide spread, indicating a lot of confusion — a confusion which still remains. The lack of sufficient quality data itself is telling, since it reveals that policy makers aren’t doing a good job of tracking these changes in the labor force, and so far have not even attempted a solid effort to do so. Shame on them.

Increasingly, I think we are going to find that more and more workers exist simultaneously in multiple worker categories — a worker, for example, who has a regular part-time job (W-2, but with little safety net), and supplements that with being an Uber driver and/or Instacart deliverer (1099 worker, still no safety net), as well as other mini-gigs and nano-gigs, and perhaps a second part-time job (temp, freelancer, etc.). Many workers already have multiple employers — sometimes within a single day! How will that look in the labor statistics? Will we be able to count this complexity, using current methods?

Toward a 21st Century Workforce

The gig economy is just one sub domain of what is happening more broadly to the workforce, including just-in-time scheduling and other disruptions to the labor markets, whether as a result of the gig economy, automation and robots, artificial intelligence and other factors. Fortune columnist Jeffrey Pfeffer writes “What is not in dispute is that the proportion of contractors, freelancers, and part-time, contingent workers in the U.S. has been increasing and has been for a long time.” I could not agree more. There are just too many independent sources whose data and research all point in the same direction. While solid numbers documenting the shifts are hard to come by, it is nevertheless abundantly clear that the old New Deal economy and its safety net is crumbling for millions of US workers. In a time of stagnant wages and unyielding economic inequality, how do we ensure that millions of contingent workers retain access to the safety net?

Some people, like U.S. Senator Mark Warner and myself, are starting to float proposals for how to deal with this, specifically how to create a “new safety net and social contract for the new economy.” Others are taking up this challenge. Hopefully we are at the outset of some changes that will transition the United States to a new economy that works for all of us, instead of only some of us.

[Steven Hill (www.Steven-Hill.com) is a senior fellow at the New America Foundation and author of the forthcoming book Raw Deal: How the “Uber Economy” and Runaway Capitalism Are Screwing American Workers]